Tag Archives: cfds

Contracts for Difference (CFDs) have become increasingly popular in financial markets due to their flexibility and accessibility. Here’s a comprehensive guide to understanding cfd how it works and their implications.

What are CFDs?

CFDs are financial derivatives that allow traders to speculate on the price movements of various assets without owning the underlying asset itself. These assets can include stocks, commodities, indices, and currencies. Essentially, CFDs enable investors to profit from price fluctuations whether the market is rising or falling.

How CFDs Work

When trading CFDs, investors enter into a contract with a broker that mirrors the price movement of the underlying asset. The profit or loss is determined by the difference between the buy and sell price of the CFD. Traders can go long (buy) if they expect the price to rise or go short (sell) if they anticipate a decline.

Key Features of CFD Trading

Leverage: CFDs offer flexible leverage, allowing traders to control a larger position with a smaller amount of capital. This amplifies both potential profits and losses, so risk management is crucial.

Market Access: CFDs provide access to a wide range of global markets and assets, enabling diversification and the ability to capitalize on various economic trends.

Cost Efficiency: Unlike traditional investing where ownership of the asset involves additional costs like stamp duty or custody fees, CFDs generally involve lower costs and fees.

Benefits of CFD Trading

Speculation: Traders can profit from both rising and falling markets.

Liquidity: CFDs are traded on margin, which means investors can enter and exit positions easily.

Hedging: CFDs can be used to hedge against existing positions in the underlying asset.

Risks of CFD Trading

Leverage Risk: While leverage can amplify profits, it also increases potential losses.

Market Risk: CFD prices mirror the underlying asset, exposing traders to market volatility.

Counterparty Risk: As CFDs are traded over-the-counter, traders are exposed to the credit risk of their broker.

Conclusion

CFDs offer a flexible and accessible way to trade various financial markets without owning the underlying assets. Understanding how CFDs work, their risks, and benefits is crucial for making informed trading decisions. With proper risk management and regulatory awareness, CFD trading can be a valuable addition to an investor’s toolkit.

In recent years, Contracts for Difference (CFDs) have emerged as a popular financial instrument among traders worldwide. This rise can be attributed to several factors, including their flexibility, accessibility, and potential for profit. Understanding the trends and opportunities associated with CFD how it works trading is crucial for both seasoned investors and newcomers to the market.

One of the key attractions of CFDs is their flexibility in terms of leverage. Unlike traditional trading methods, which often require substantial capital investment, CFDs allow traders to enter the market with relatively small amounts of money, thanks to flexible leverage options. This means that traders can amplify their potential profits, but it’s essential to remember that it also increases the risk of losses. Therefore, prudent risk management strategies are crucial when trading CFDs.

Another trend shaping the CFD market is the increasing availability of a diverse range of underlying assets. While CFDs were initially associated with equities, they now encompass a wide array of assets, including indices, commodities, cryptocurrencies, and forex pairs. This expanded selection provides traders with more opportunities to diversify their portfolios and capitalize on various market trends.

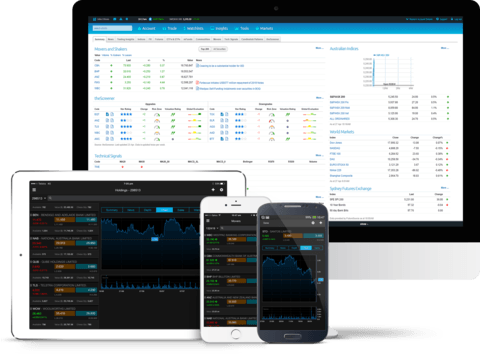

Furthermore, technological advancements have transformed the landscape of CFD trading, making it more accessible than ever before. Online trading platforms and mobile applications have streamlined the process, allowing traders to execute trades from anywhere with an internet connection. Additionally, the integration of advanced analytical tools and real-time market data has empowered traders to make informed decisions and react swiftly to market developments.

Despite the opportunities presented by CFD trading, it’s essential to approach it with caution and diligence. The inherent leverage associated with CFDs magnifies both profits and losses, making risk management a top priority for traders. It’s crucial to set clear investment goals, establish stop-loss orders, and diversify your portfolio to mitigate risk effectively.

In conclusion, the rise of Contracts for Difference (CFDs) represents a significant shift in the financial markets, offering traders unparalleled flexibility and opportunity. By understanding the trends shaping the CFD market and adopting prudent risk management practices, investors can capitalize on the potential of this dynamic trading instrument while minimizing exposure to risk. As with any form of trading, thorough research, discipline, and a long-term perspective are key to success in the world of CFDs.