Daily Archives: May 21, 2024

MetaTrader 4 (MT4) is a popular trading platform used by traders worldwide for its comprehensive charting tools, robust trading capabilities, and user-friendly interface. One of the ways to enhance your efficiency when using metatrader 4 is by mastering its keyboard shortcuts and hotkeys. These shortcuts can save you time, streamline your workflow, and allow you to execute trades more swiftly.

Why Use Keyboard Shortcuts in MetaTrader 4?

Keyboard shortcuts can significantly improve your productivity by reducing the time spent navigating through menus. Instead of clicking multiple times to perform common tasks, you can use a single key combination to get the job done quickly. This is particularly useful in fast-paced trading environments where every second counts.

Commonly Used Keyboard Shortcuts in MetaTrader 4

Chart Navigation and Management

• F11: Switch to full-screen mode. This is useful for getting a better view of your charts without any distractions.

• Ctrl + G: Show/hide grid on the chart. This helps in focusing on price movements without the clutter.

• Ctrl + Y: Show/hide period separators. This allows you to see the beginning of each trading day, week, or month.

• + (Plus Key): Zoom in on the chart. This is helpful for a closer look at price movements.

• – (Minus Key): Zoom out on the chart. Useful for getting a broader view of price trends.

Trading Actions

• F9: Open the ‘New Order’ window. This shortcut is crucial for quickly placing trades.

• F5: Switch between different chart types (bar, candlestick, and line). This helps in analyzing the market from different perspectives.

• Ctrl + E: Enable/disable Expert Advisors (EAs). This allows you to quickly control automated trading systems.

Navigating the Platform

• Ctrl + T: Show/hide the ‘Terminal’ window. This window contains essential information like your account balance, trade history, and alerts.

• Ctrl + M: Show/hide the ‘Market Watch’ window. This window lists the available trading instruments and their prices.

• Ctrl + N: Show/hide the ‘Navigator’ window. This window gives you quick access to your accounts, indicators, and scripts.

Customization and Settings

• F8: Open the ‘Chart Setup’ window. This allows you to customize the appearance of your charts.

• Ctrl + O: Open the ‘Options’ window. This is where you can configure various settings for the platform.

Tips for Using Keyboard Shortcuts Effectively

1. Practice Regularly: The more you use these shortcuts, the more familiar they will become.

2. Customize Your Own Shortcuts: MT4 allows you to set custom hotkeys for certain actions. This can tailor the platform to your specific needs.

3. Use Shortcut Guides: Keep a list of essential shortcuts handy until you memorize them.

Conclusion

Mastering keyboard shortcuts in MetaTrader 4 can significantly enhance your trading efficiency and overall experience on the platform. By incorporating these shortcuts into your daily trading routine, you can navigate the platform more swiftly, execute trades faster, and ultimately become a more effective trader. Happy trading!

In recent years, Contracts for Difference (CFDs) have emerged as a popular financial instrument among traders worldwide. This rise can be attributed to several factors, including their flexibility, accessibility, and potential for profit. Understanding the trends and opportunities associated with CFD how it works trading is crucial for both seasoned investors and newcomers to the market.

One of the key attractions of CFDs is their flexibility in terms of leverage. Unlike traditional trading methods, which often require substantial capital investment, CFDs allow traders to enter the market with relatively small amounts of money, thanks to flexible leverage options. This means that traders can amplify their potential profits, but it’s essential to remember that it also increases the risk of losses. Therefore, prudent risk management strategies are crucial when trading CFDs.

Another trend shaping the CFD market is the increasing availability of a diverse range of underlying assets. While CFDs were initially associated with equities, they now encompass a wide array of assets, including indices, commodities, cryptocurrencies, and forex pairs. This expanded selection provides traders with more opportunities to diversify their portfolios and capitalize on various market trends.

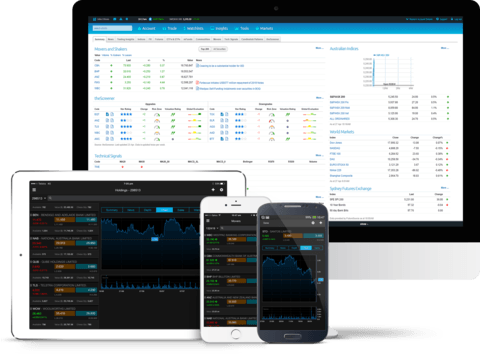

Furthermore, technological advancements have transformed the landscape of CFD trading, making it more accessible than ever before. Online trading platforms and mobile applications have streamlined the process, allowing traders to execute trades from anywhere with an internet connection. Additionally, the integration of advanced analytical tools and real-time market data has empowered traders to make informed decisions and react swiftly to market developments.

Despite the opportunities presented by CFD trading, it’s essential to approach it with caution and diligence. The inherent leverage associated with CFDs magnifies both profits and losses, making risk management a top priority for traders. It’s crucial to set clear investment goals, establish stop-loss orders, and diversify your portfolio to mitigate risk effectively.

In conclusion, the rise of Contracts for Difference (CFDs) represents a significant shift in the financial markets, offering traders unparalleled flexibility and opportunity. By understanding the trends shaping the CFD market and adopting prudent risk management practices, investors can capitalize on the potential of this dynamic trading instrument while minimizing exposure to risk. As with any form of trading, thorough research, discipline, and a long-term perspective are key to success in the world of CFDs.